Strategy Consulting

Shaping prior to a Transaction

Starting point for any M & A activity is the determination of the company's strategy.

Who does not define where he wants to go, will not get there.

The process of transfer of the company is complex and in each case individually different. Therefore, a clearly structured support in particular for the seller is of great benefit.

Strategy Check

A compact company check combined with a strength / weakness analysis serves as an entry to timely recognize the essential need for action and initiate immediate and fast simple remedies.

Not every company is directly suitable for sale. But even well-organized companies can increase their sales opportunities with regard to a transaction.

Therefore we offer - on request beyond the mere accompaniment of the M & A process - prior to a company transition a strategic M & A consulting and process optimization.

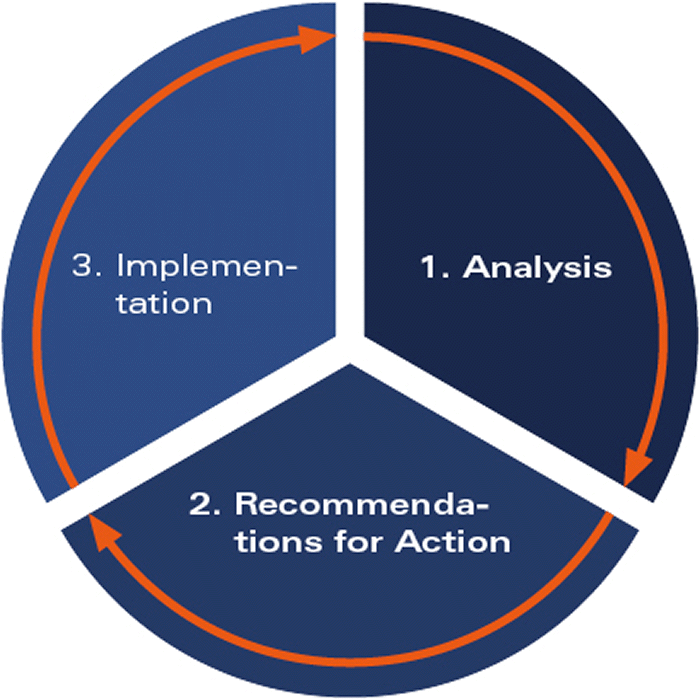

To get started a compact Strategy Check or Company Check of your company on potentials and recommendations for action can be made in a first step.

The Company Check and the strategy consulting are always customized and are used for internal preparation of handover activities. These can also be extended to the tracing and improvement of sales potentials.

An analysis and the possible initiation of targeted action takes place reasonably before defining the corporate sales strategy.